In the United States, to be considered an accredited investor, a natural person must have a net worth of at least $1,000,000, excluding the value of one's primary residence, or have income at least $200,000 each year for the last two years (or $300,000 combined income if married) and have the expectation to make the same amount this year, or must otherwise be a holder of a specific license in good standing.

If you are an accredited investor, please click "Yes". Otherwise click "No"

In the United States, to be considered an accredited investor, a natural person must have a net worth of at least $1,000,000, excluding the value of one's primary residence, or have income at least $200,000 each year for the last two years (or $300,000 combined income if married) and have the expectation to make the same amount this year, or must otherwise be a holder of a specific license in good standing.

If you are an accredited investor, please click "Yes". Otherwise click "No"

In the United States, to be considered an accredited investor, a natural person must have a net worth of at least $1,000,000, excluding the value of one's primary residence, or have income at least $200,000 each year for the last two years (or $300,000 combined income if married) and have the expectation to make the same amount this year, or must otherwise be a holder of a specific license in good standing.

If you are an accredited investor, please click "Yes". Otherwise click "No"

In the United States, to be considered an accredited investor, a natural person must have a net worth of at least $1,000,000, excluding the value of one's primary residence, or have income at least $200,000 each year for the last two years (or $300,000 combined income if married) and have the expectation to make the same amount this year, or must otherwise be a holder of a specific license in good standing.

If you are an accredited investor, please click "Yes". Otherwise click "No"

Welcome to LendingRobot — Your gateway to the world of alternative Investments!

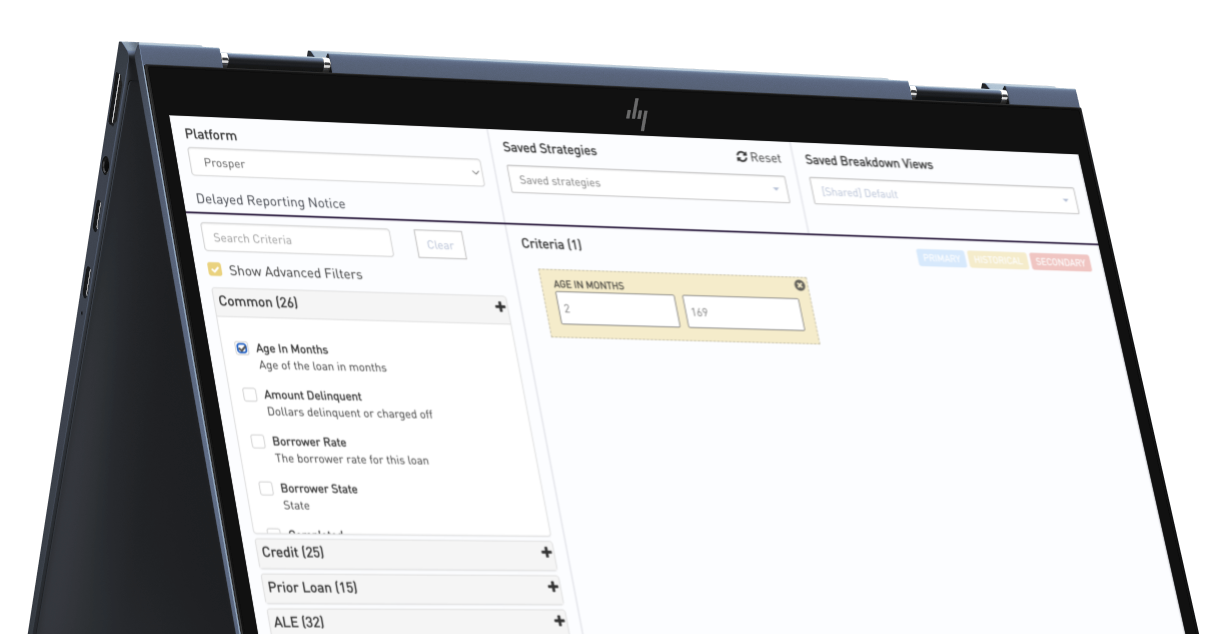

With deep roots in the peer-to-peer (P2P) lending landscape, we have evolved into a company that offers a diverse range of investment funds and private investment options, focusing on alternative credit and loans.

Explore the future of investing with LendingRobot today and embark on a journey that promises innovation, expertise, and prosperity.